India’s digital payments ecosystem has expanded rapidly over the past few years, transforming how individuals, businesses, and government agencies conduct transactions. With this growth has also come a rise in online fraud, data misuse, and cybercrime. To address these risks while maintaining trust in digital platforms, the government and financial regulators have introduced updated rules focused on strengthening digital payment security and preventing online fraud. These changes are aimed at protecting consumers, improving accountability among service providers, and ensuring the long-term stability of India’s digital economy.

Why the New Rules Were Needed

Digital payments have become an everyday necessity in India, from small merchant transactions to large-value business payments. While this shift has improved financial inclusion and convenience, it has also created opportunities for fraudsters who exploit weak security practices, user unawareness, and gaps in monitoring systems.

The updated rules are a response to increasing cases of unauthorised transactions, phishing scams, fake payment links, and identity theft. Authorities have recognised that technological innovation must be matched with stronger safeguards, especially as first-time users and vulnerable groups increasingly rely on digital platforms.

Stronger Customer Authentication Measures

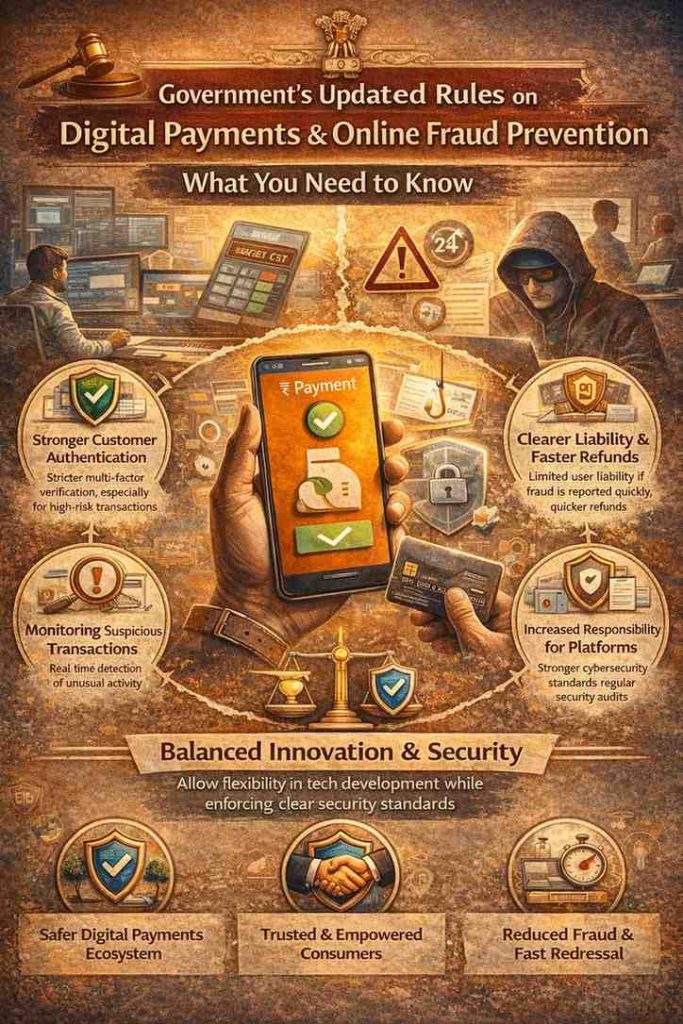

One of the central aspects of the updated framework is enhanced customer authentication. Payment service providers are now required to implement stricter verification mechanisms, especially for high-risk transactions. This includes improved multi-factor authentication processes that go beyond basic PINs or passwords.

The intent is to ensure that even if fraudsters gain access to partial user information, they are unable to complete transactions without additional layers of verification. These measures are particularly important for remote and card-not-present transactions, where the risk of misuse is higher.

Tighter Monitoring of Suspicious Transactions

Another key focus of the new rules is real-time monitoring and faster detection of suspicious activity. Banks and payment intermediaries are expected to use advanced analytics and automated systems to identify unusual transaction patterns, such as sudden high-value transfers or repeated failed authentication attempts.

Once a potentially fraudulent transaction is flagged, service providers are required to act quickly by alerting customers, temporarily restricting accounts if necessary, and initiating internal investigations. This proactive approach aims to reduce financial losses and prevent fraud from escalating.

Clearer Liability and Faster Refunds for Users

For consumers, one of the most significant changes relates to liability in cases of unauthorised transactions. The updated rules clarify the responsibilities of users, banks, and payment platforms depending on how and when fraud is reported.

If customers report unauthorised transactions promptly, their liability is limited, and service providers are required to process refunds within a defined timeframe. This clarity is intended to restore confidence among users, many of whom hesitate to adopt digital payments due to fear of losing money with little recourse.

Increased Responsibility for Payment Platforms

The new framework places greater responsibility on banks, fintech companies, and payment aggregators. These entities must invest in stronger cybersecurity infrastructure, conduct regular security audits, and ensure compliance with data protection standards.

Platforms are also required to educate users about safe digital practices, such as avoiding unknown links, protecting personal information, and reporting suspicious activity immediately. By making service providers accountable not just for transactions but also for user awareness, the rules aim to address fraud at both technological and behavioural levels.

Focus on Consumer Awareness and Education

Recognising that technology alone cannot eliminate fraud, the updated rules emphasise the importance of consumer awareness. Public information campaigns and in-app alerts are encouraged to inform users about common fraud techniques and preventive steps.

Simple measures such as verifying payment requests, avoiding sharing one-time passwords, and using official apps are repeatedly highlighted. Over time, this focus on education is expected to build safer digital habits among users across age groups and regions.

Impact on Businesses and Merchants

For businesses and merchants, the updated rules mean stricter compliance requirements but also a more secure payment environment. Merchants may need to upgrade systems, follow additional verification protocols, and cooperate more closely with payment service providers.

While these changes may involve short-term adjustments, they are expected to reduce disputes, chargebacks, and reputational risks in the long run. A safer digital payments ecosystem benefits businesses by encouraging customer trust and repeat usage.

Balancing Innovation and Regulation

A key challenge for policymakers has been balancing innovation with regulation. India’s digital payments sector is known for rapid innovation, and overly restrictive rules could slow progress. The updated framework seeks to strike a balance by allowing technological flexibility while setting clear minimum standards for security and consumer protection.

By focusing on outcomes such as reduced fraud, faster redressal, and improved transparency, the rules aim to support innovation without compromising safety.

What This Means for Users Going Forward

For everyday users, the updated rules translate into safer transactions, clearer rights, and faster support in case something goes wrong. While users may notice additional authentication steps or alerts, these are designed to protect their money and personal data.

As digital payments continue to evolve, the success of these measures will depend on effective implementation, cooperation between regulators and service providers, and continued public awareness. Together, these updated rules represent a significant step toward building a more secure, trusted, and inclusive digital payments ecosystem in India.

Add indiapioneer.in as preferred source on google – click here