The Union Budget 2026 has delivered a carefully calibrated message to Indian students dreaming of global education. At a time when overseas study has become both a career necessity and a financial strain for middle-class families, the government has attempted to ease one major pain point while tightening another. By reducing the Tax Collected at Source (TCS) on overseas education remittances and simultaneously introducing clearer foreign asset disclosure rules, the Budget seeks to strike a balance between affordability, transparency, and tax compliance.

For lakhs of Indian students heading to universities in the United States, the United Kingdom, Canada, Australia, and Europe, these changes are not merely technical tax tweaks. They directly affect how much money families must arrange upfront, how students manage finances abroad, and how they report their global financial footprint once they return to India.

Understanding the Burden of TCS on Overseas Education Before Budget 2026

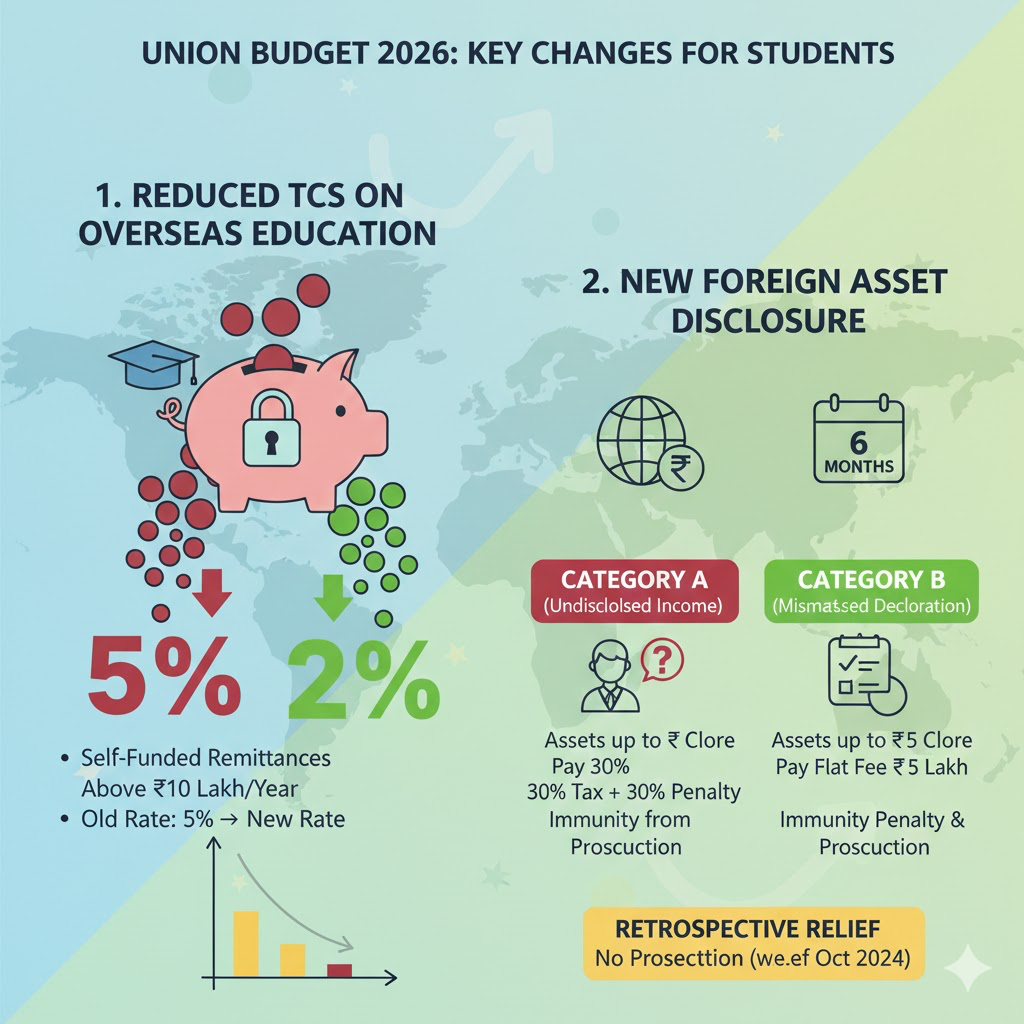

In recent years, TCS on foreign remittances under the Liberalised Remittance Scheme had emerged as a significant financial hurdle for students. Although TCS is adjustable against final tax liability, it often required families to block large sums of money upfront while paying tuition fees, accommodation deposits, or university-related expenses.

For education funded through personal savings rather than education loans, the higher TCS rates introduced earlier had a disproportionate impact. Many families were forced to dip into emergency savings or take short-term loans simply to meet the additional tax collection, even though they would later claim refunds. This cash-flow pressure became one of the most frequently raised concerns by student bodies, parents, and education consultants.

Reduced TCS on Overseas Education: What Has Changed

Responding to these concerns, the Union Budget 2026 has announced a reduction in TCS applicable to overseas education remittances, particularly for students paying fees directly to foreign institutions. The revised rates significantly lower the upfront tax burden, ensuring that families do not have to lock away substantial funds for months while waiting for refunds.

This move is especially beneficial for middle-income households, where education abroad is often financed through a combination of savings, partial loans, and family contributions. By easing immediate cash requirements, the government has effectively made overseas education more accessible without increasing subsidies or direct spending.

Education experts see this as a pragmatic reform that acknowledges the reality of rising global tuition fees and currency fluctuations, which already inflate the cost of studying abroad.

Who Benefits the Most from the TCS Reduction

The reduced TCS structure particularly benefits students pursuing undergraduate and postgraduate degrees overseas who are self-funded or partially funded. Families sending money in multiple tranches for tuition, housing, and living expenses will now experience lower cumulative deductions.

Students from smaller towns and non-metro cities, where awareness of tax refund mechanisms is limited, are also expected to gain. Earlier, many families treated TCS as a permanent cost due to procedural complexity or lack of tax filing confidence. The reduction therefore translates into real, not just theoretical, savings for such households.

New Foreign Asset Disclosure Rules: A Shift Towards Transparency

While the Budget has softened its stance on TCS, it has simultaneously sharpened its focus on financial disclosures. One of the most significant announcements for students is the clarification and expansion of foreign asset disclosure rules under Indian tax laws.

Students studying abroad often open foreign bank accounts, hold part-time income, receive scholarships, or invest small amounts overseas. Until now, many were unaware that certain assets needed to be disclosed in Indian tax returns, especially if they later became residents again.

The Union Budget 2026 makes these requirements clearer and more structured, leaving little room for ambiguity.

What Counts as a Foreign Asset Under the New Rules

Under the revised framework, foreign bank accounts, overseas investments, certain digital assets held abroad, and financial interests acquired during the period of study may fall under disclosure requirements once the individual qualifies as a resident for tax purposes in India.

Importantly, the Budget has emphasized intent and thresholds, indicating that inadvertent non-disclosure by genuine students will not be treated on par with willful tax evasion. However, failure to disclose after becoming aware of obligations may attract scrutiny and penalties.

Impact on Returning Students and Young Professionals

The new disclosure norms are particularly relevant for students who return to India after completing their education and begin earning domestically. Many such individuals continue to hold foreign savings accounts or receive residual income such as internships stipends, research grants, or investment returns.

The Budget sends a clear signal that global financial exposure must be transparently reported once tax residency shifts back to India. Tax advisors believe this will encourage better financial planning among young professionals from the very beginning of their international journey.

Balancing Ease and Accountability

Taken together, the reduced TCS and strengthened disclosure framework reflect a broader policy philosophy. The government appears keen to support education and skill development abroad while ensuring that cross-border financial flows remain accountable and traceable.

Rather than discouraging overseas education, the Budget acknowledges its role in building global competence and future leadership. At the same time, it reinforces that international exposure does not place individuals outside the ambit of Indian tax responsibility.

What Students and Parents Should Do Now

With these changes in place, students and parents are advised to maintain proper documentation of all foreign remittances, fee receipts, scholarships, and bank accounts opened abroad. Early consultation with tax professionals can prevent confusion later, especially when residency status changes.

Educational institutions and study-abroad consultants are also expected to play a greater role in spreading awareness about tax compliance, ensuring that students are financially literate before they leave India.

A Budget That Recognises Global Aspirations

The Union Budget 2026 marks an important evolution in how India views student mobility and international education. By reducing immediate financial pressure through lower TCS while insisting on long-term transparency via foreign asset disclosures, the government has attempted to walk a careful line.

For students, the message is encouraging yet clear. The state supports global ambition, but it also expects financial responsibility. As Indian students continue to make their mark on campuses worldwide, the Budget ensures that their journey is smoother, smarter, and more accountable from a financial standpoint.

Also read : Union Budget 2026 for Students: Key Policies for Education Loans, Skill Development, and New Universities

Add indiapioneer.in as a preferred source on google – click here