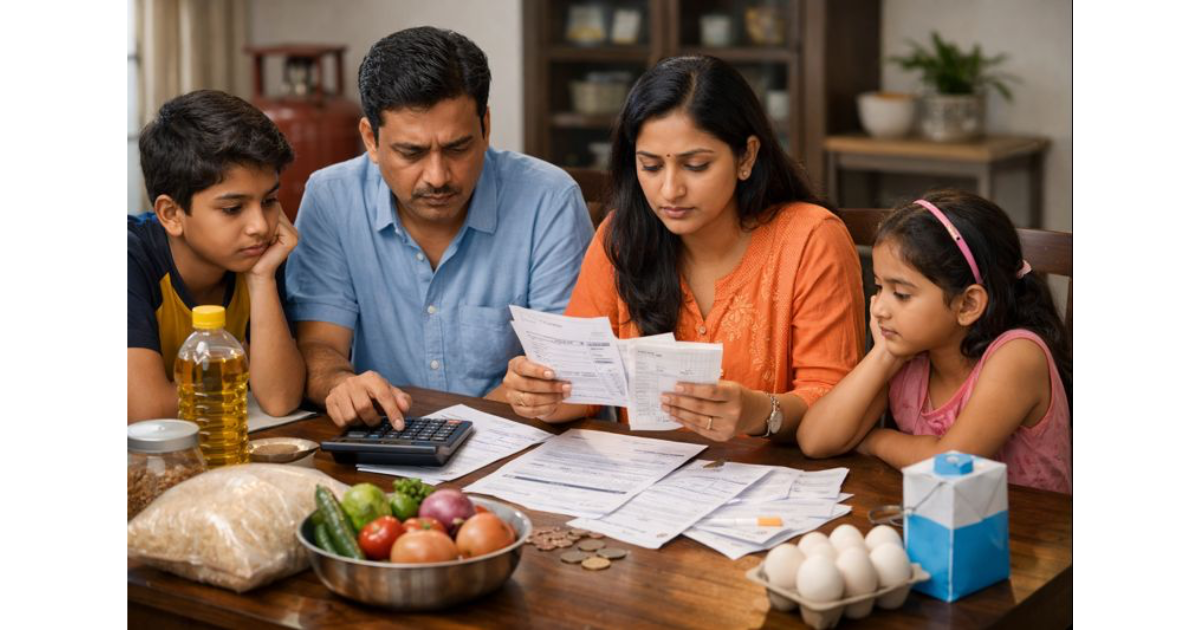

Inflation, once a term mostly heard in economic debates and policy discussions, has firmly entered everyday household conversations across India. From grocery shopping to school fees and utility bills, families are feeling the pressure of rising prices in ways that directly affect their monthly budgets and long-term financial planning. While official inflation numbers may fluctuate month to month, the lived experience of citizens tells a deeper story of tightening expenses and careful trade-offs.

Over the past year, price increases have been driven by a mix of global factors such as energy costs and supply chain disruptions, alongside domestic issues including food production volatility and rising service sector costs. For the average household, this has translated into higher spending without a corresponding rise in income, making budgeting a growing challenge.

The Growing Cost of Food and Essentials

Food inflation has emerged as one of the most visible and emotionally felt aspects of rising prices. Staples such as rice, wheat flour, pulses, cooking oil, vegetables, and milk have seen steady increases, forcing families to either cut quantities or switch to lower-priced alternatives. Seasonal vegetables, once a flexible part of the household menu, have become unpredictable expenses, particularly in urban areas where transportation and storage costs add to retail prices.

Protein sources such as pulses, eggs, and dairy products have also become costlier, raising concerns about nutrition, especially for middle- and lower-income families. Many households report spending a significantly higher share of their income on groceries compared to previous years, leaving less room for savings or discretionary spending.

Fuel Prices and the Ripple Effect on Daily Life

Rising fuel prices continue to have a cascading impact on household expenses. Even for families that do not own private vehicles, higher petrol and diesel costs push up public transport fares, auto-rickshaw charges, and delivery fees. These increases quietly make their way into the cost of food, clothing, and other essentials, as transportation remains a critical link in supply chains.

For working professionals and small business owners who rely on daily commuting, fuel inflation directly affects monthly expenses. In many cases, households are forced to reassess travel habits, combine trips, or shift to public transport where possible, though even these options have become more expensive.

Housing, Rent, and Utility Bills Under Pressure

Housing costs have also felt the impact of inflation. In urban centres, rents have risen steadily, driven by increased demand, higher maintenance costs, and rising property taxes. Tenants, particularly young professionals and migrant workers, are finding it harder to negotiate rent freezes or minimal hikes.

Utility bills add another layer of strain. Electricity tariffs, cooking gas prices, water charges, and mobile and internet bills have all seen upward revisions. While each increase may appear modest on its own, together they significantly inflate monthly fixed expenses, reducing financial flexibility for households.

Education and Healthcare Expenses Continue to Rise

Education and healthcare, two essential pillars of household spending, have not been immune to inflationary pressures. School fees, transportation charges, uniforms, books, and extracurricular costs have risen across both private and semi-private institutions. Parents are increasingly forced to prioritise expenses and postpone additional learning activities.

Healthcare costs, including consultation fees, diagnostic tests, medicines, and health insurance premiums, have also increased. For families managing chronic illnesses or elderly care, inflation in medical expenses poses serious financial stress and often leads to difficult decisions about treatment timing and coverage.

How Inflation Is Reshaping Household Financial Behaviour

Rising inflation is not just increasing expenses; it is reshaping how households manage money. Many families are becoming more cautious, cutting back on non-essential spending such as dining out, entertainment, and discretionary purchases. There is a noticeable shift towards value-based shopping, bulk buying where possible, and increased reliance on discounts and digital offers.

Savings patterns are also changing. With higher monthly outflows, the ability to save regularly has declined for many households. Some families are dipping into emergency funds or postponing long-term goals such as home purchases, higher education planning, or retirement savings.

Government Measures and What Citizens Should Watch

The government and the Reserve Bank of India have taken steps to manage inflation through policy measures such as interest rate adjustments, supply-side interventions, and targeted subsidies. While these actions aim to stabilise prices over time, their effects are often gradual and uneven across sectors.

For citizens, staying informed about policy changes, subsidy eligibility, and tax relief measures has become increasingly important. Budget announcements, fuel price revisions, and food supply policies now have direct consequences for household finances, making economic awareness a practical necessity rather than a specialist interest.

Looking Ahead: Navigating Inflation With Caution and Planning

Inflation is expected to remain a key economic challenge in the near future, with its impact varying across income groups and regions. While complete insulation from rising prices is difficult, households that actively review budgets, prioritise spending, and plan savings strategically may be better positioned to cope.

For millions of Indian families, inflation is no longer an abstract economic indicator but a daily reality influencing choices, habits, and aspirations. As prices continue to shape household decisions, the need for informed financial planning and responsive policy support has never been more critical.

Also read : https://newsestate.in/a-budget-without-slab-shocks-continuity-and-stability-in-personal-taxation/

Add indiapioneer.in as a preferred source on google – click here